The landscape of the real estate sector is undergoing a significant transformation, with digital verification poised to play a crucial role in enhancing customer experiences and mitigating fraud risks.

In every industry, including real estate, there’s a shift towards improving digital service delivery. Traditionally characterized by in-person interactions, manual processes, and physical document exchanges, the real estate industry is now embracing digital avenues. This shift enables home buyers and renters to execute numerous steps—such as mortgage applications and real estate transactions—entirely online. However, this digital transition also brings an increased risk of fraud, underscoring the need for robust digital verification measures.

As the real estate industry evolves, implementing digital verification becomes critical for delivering superior customer experiences and reducing fraud. Digital verification ensures the authenticity of home buyers and renters, confirming their identity and foundational data.

A well-established verification framework, leveraging data sources, can offer secure and straightforward access to services throughout the real estate chain. Digital verification allows home builders and property managers to swiftly to authenticate applicants and access credible affordability.

The benefits of digital verification extend beyond fraud reduction; it enhances convenience for home buyers and renters and streamlines the housing journey. This allows real estate professionals to meet customer expectations efficiently and with confidence.

The Digital Interaction Dilemma in Real Estate

Despite the clear advantages of digital solutions in accelerating transactions and offering greater convenience, the digital exchange of sensitive documents (like IDs, income statements, or credit reports) via email and other channels elevates the risk of fraud.

The surge in virtual transactions has coincided with an increase in real estate fraud, particularly as digital interactions diminish the opportunity for spotting red flags compared to in-person meetings.

Enhancing the Real Estate Experience with Digital Verification

Digital verification empowers all parties in a real estate transaction—be it buyers, sellers, landlords, or renters—to securely authenticate themselves and digitally exchange information.

Benefits for Real Estate Agencies and Brokerages:

– Fraud Mitigation: Secure digital verification tools connect with customers’ financial institutions, providing real estate professionals with accurate identity and financial data, thus reducing identity fraud risks.

– Administrative Efficiency: Streamlines compliance with Know Your Client (KYC) requirements, reducing manual and error-prone verification processes.

– Enhanced Digital Access: Facilitates verification for customers unable to meet in person, expediting the verification process and lowering administrative burdens.

Benefits for Home Buyers:

– Increased Convenience: Digital verification offers an alternative to in-person identity verification and cumbersome paperwork, streamlining the approval process with mortgage providers and legal professionals.

– Privacy Protection: Offers a more secure way for customers to share their information, guarding against fraud.

– Impersonation Protection: Accurately confirms customer details, minimizing fraud risks.

Benefits for the Rental Market:

– Security for Renters: Offers a secure and convenient verification method, providing peace of mind.

– Faster Application Processes: Enables property managers to quickly verify applicants, accessing affordability and proof of income efficiently.

– Time Savings for Renters: Accelerates document submission processes for renters.

Digital Verification in Practice

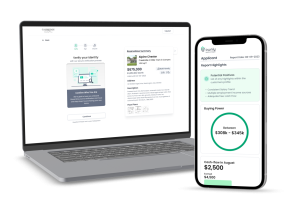

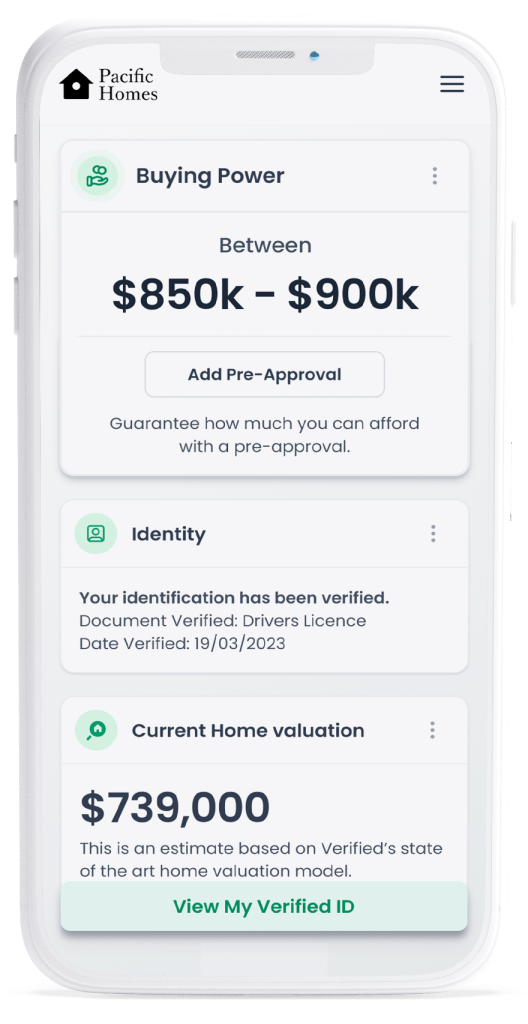

Consider the journey of a customer purchasing a home, where digital verification streamlines each step, from mortgage pre-approval to closing the deal. This approach removes the need for physical documents, radically transforming housing transactions.

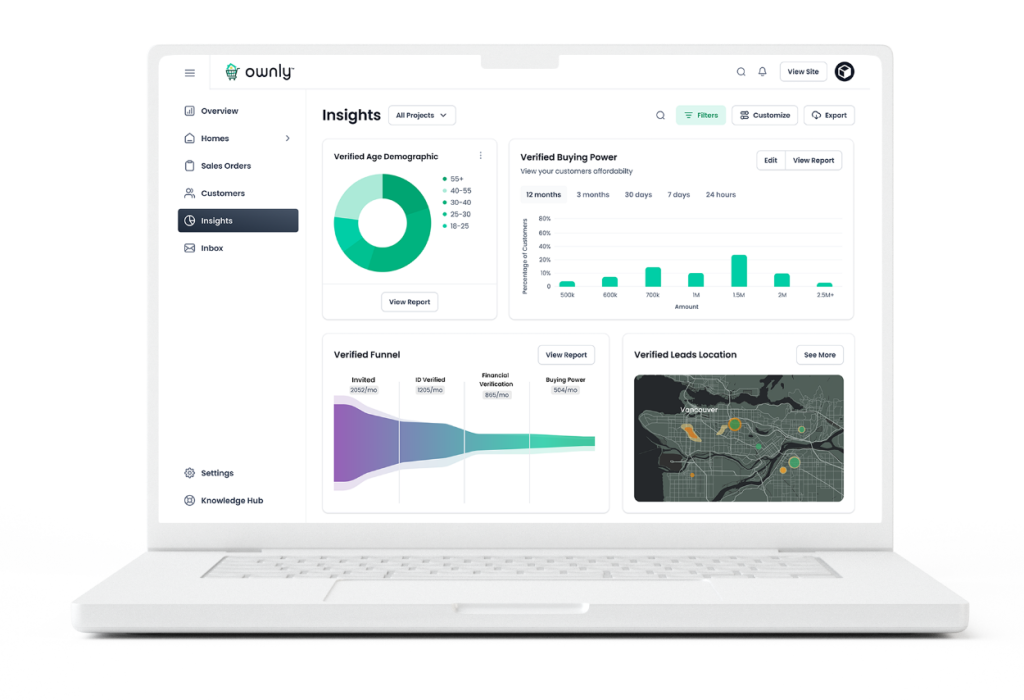

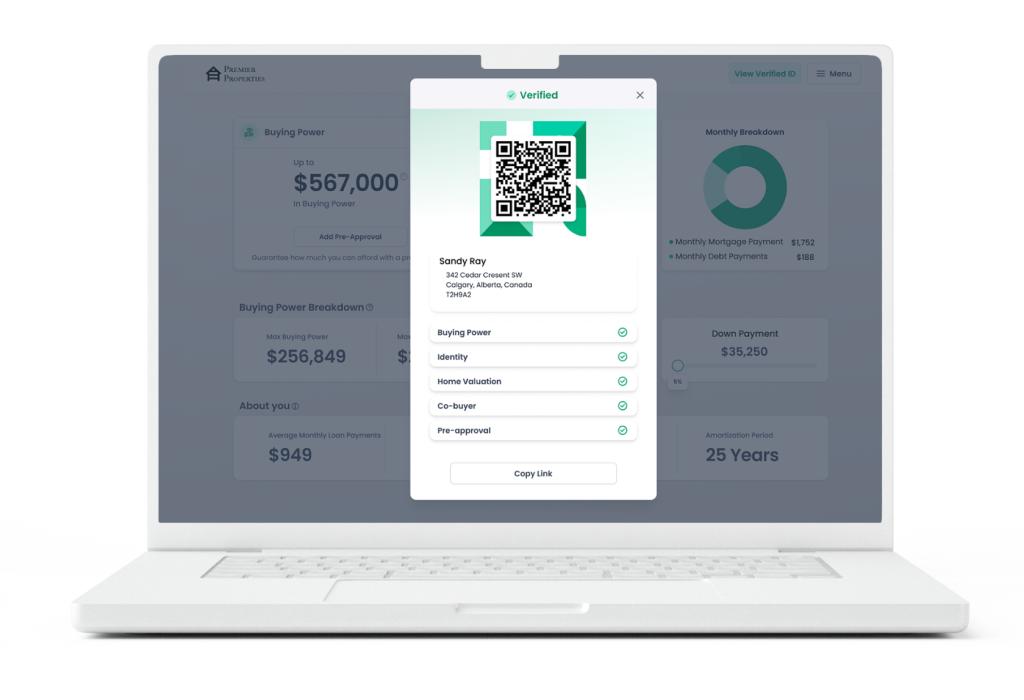

How Ownly’s Verified Enhances the Process

Ownly’s Verified introduces a suite of verification and authentication solutions trusted by Canadians. It supports new home builders, real estate agents, and property managers in verifying customer identities and data, thus improving digital experiences and compliance adherence without physical documents or in-person meetings. Ownly’s Verified offers two pivotal verification options: document verification and data verification services, both designed to simplify and secure real estate transactions.

Advancing Real Estate Interactions

Today’s real estate transactions demand security, trust, and adaptability. With the sector’s continued digital shift, real estate professionals must have access to tools that reliably verify client information. Ownly’s Verified aims to redefine digital verification in real estate, enhancing customer journeys and empowering professionals to confidently navigate the changing landscape.

Embrace digital verification with Ownly Verified and witness its transformative impact on the real estate industry.