We’re consciously or unconsciously looking for that next home all the time. We know the neighborhood, the street, even the address. At the same time, we seem to be constantly curious about what our current home is worth and what the neighbor’s house sold for last week. Did they do a reno as nice as ours? Was their backyard fully landscaped? I wonder what it sold for? They say comparison is the thief of joy but when it comes to real estate, we can’t seem to help ourselves.

The fact is, we as home seekers begin our search for that next home long before we call the agent or get that pre-approval. More than 67% of homebuyers start looking for their next home more than 3-months prior to engaging an agent. Regardless of interest rates and inventory fluctuations, we often find ourselves searching, keeping an eye or full-blown researching our next home. In a post-pandemic world, 43% of Americans begin the search for their next home online and a whopping 50% of Americans say they are always ‘passively’ looking for their next home.

The question on every agent’s mind should be, how can we engage them earlier and help guide them?

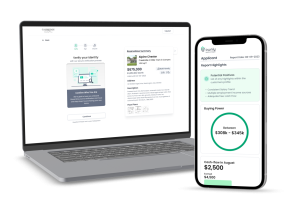

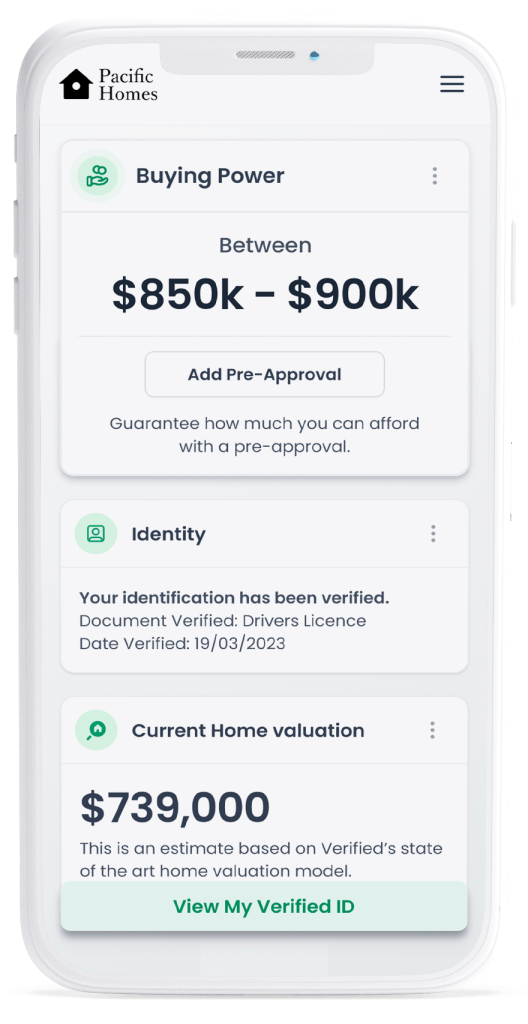

For many, if not most buyers, the journey begins with a head full of doubt and uncertainty. What can we afford? How much would that be a month? Will the raise I got this year allow us to buy something bigger? What’s my home worth now? Should I have leased that BMW? What can we afford together? So many fucking questions with no concrete answers especially at those moments when they could better influence our collective decision making. Marc Davison, Co-Founder of 1000watt recently shared his belief about the real estate journey being one where buyers and sellers spend most of it with uncertainty right up until the last act of the transaction – the closing.

In today’s world of well-researched consumers, first time and sophisticated buyers alike know what’s involved in getting pre-approved for a mortgage. It’s a stressful, nerve-racking, daunting, doubt-fuelled process that most avoid until the absolute last minute –until we have finally found that next home. We want to know our buying power and what we can afford almost as much as we want to find our next home. Today’s savvy shoppers know what the pre-approval process entails and most would rather ‘shop around’ for weeks and months before taking that next, big step.

Despite this, 46% of aspiring American homeowners say their primary barrier to buying a home is the fear of not having enough income. That fear is based on a very real problem for anyone who is not paying all cash for a property which is not having a clear sense of their purchase power from the start.

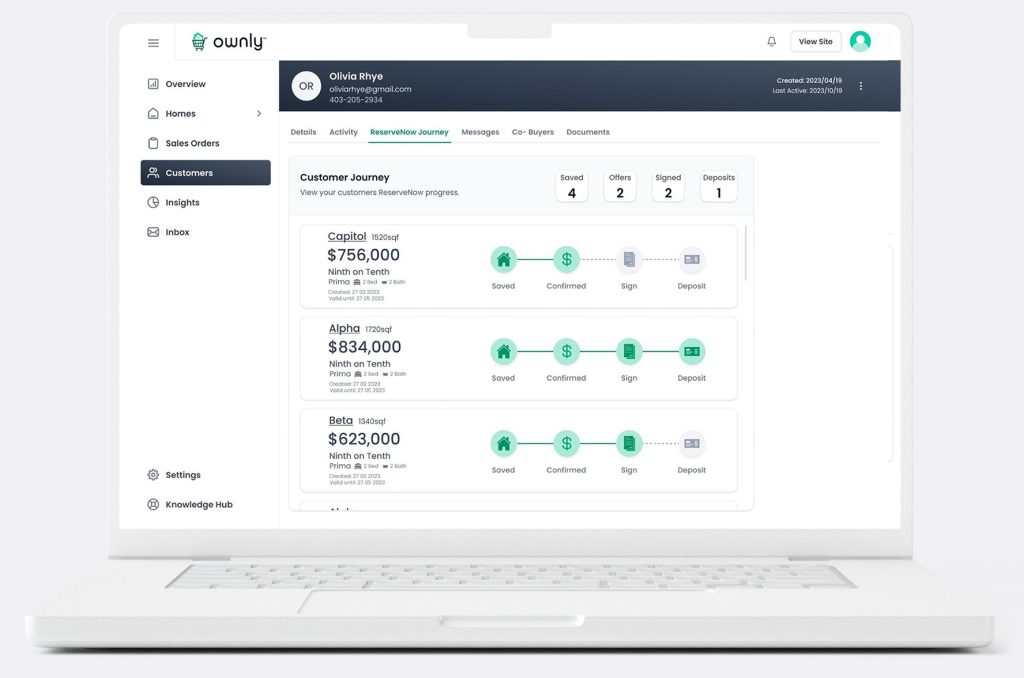

As any Realtor knows, once they begin working with a buyer, this becomes the first issue they

need to resolve in order to ensure any semblance of success.

There’s no ‘doubt’ about it, today’s home shoppers are starting the search for their next home earlier than ever before. Given the current economic climate, buyers are spending more time now than ever searching before engaging. Most search within the parameters of listing prices with no sense of what they can really afford. In this window of precious time, where buyers typically dream, think, plod, plan and randomly search for homes without a a crystal clear sense of what they can afford, that agent can and should offer services that would give buyers more clarity, more confidence and kickstart their real estate journey with less ambiguity.

In a world where real estate has created solutions for buyers across most of the transactional journey, addressing the pre-start of that journey — the moments before they even start searching — appears to still be a blue ocean of opportunity and a great time for agents to generate inquiries and solidify new, confident clientele.